- TOP

- insights_news

- News

- Announcement of the Seminar – Japan-Australia Inheritance Seminar –

Insights & News

Announcement of the Seminar – Japan-Australia Inheritance Seminar –

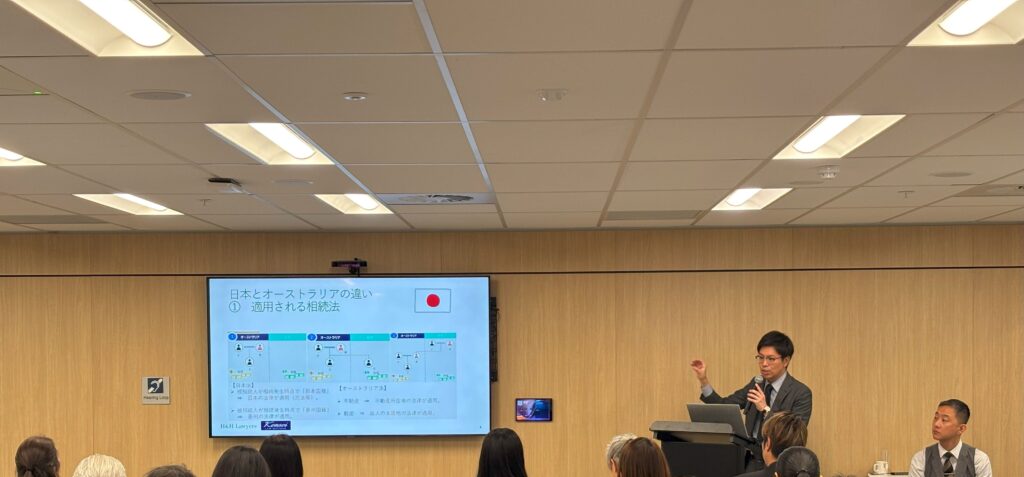

Our firm (Person in Charge: Ken Takahashi / Partner) will participate in the seminar titled “Japan-Australia Inheritance Seminar: Essential knowledge regarding inheritance legal matters and taxes in Japan and Australia”, as the speaker covering Japanese law.

Although this seminar will be conducted in Japanese, we warmly encourage anyone interested to attend.

Melbourne Venue:

- Date & Time: Wednesday, November 6, 2024, from 16:00 to 18:00 (local time)

- Location: Karstens Melbourne

Level 3, Room #302

123 Queen Street, Melbourne, Victoria 3000, Australia / MAP

Sydney Venue:

- Date & Time: Friday, November 8, 2024, from 16:00 to 18:00 (local time)

- Location: The College of Law Headquarters, Sydney

Level 4

570 George Street, Sydney NSW 2000, Australia / MAP

Please Note:

- This seminar will be held in-person at the venues only.

- Participation is free of charge.

- For further details and registration, please refer to here and here (English version).

-Post-event update–:

We are pleased to share that the Japan-Australia Cross Border Inheritance Seminar, as previously announced, was successfully held on November 6 and 8, 2024, in Melbourne and Sydney.

Our firm’s partner, Ken Takahashi, took the stage as a speaker on Japanese legal matters.

The events were well-attended, with approximately 40 participants registering for the Melbourne session and about 80 for the Sydney session.

At our firm, we specialize in assisting with matters related to Japanese assets, working closely with Australian lawyers who specialize in wills and inheritance law and Japanese tax accountants specializing in international inheritance tax.

Our expertise includes drafting wills involving Japanese assets, handling inheritance procedures in Japan after the commencement of an inheritance, mediating inheritance distribution agreements among heirs, and assisting with renouncing inheritance where necessary.

If you have any inquiries or require assistance, please feel free to contact us anytime.

Finally, for your reference, the details of the seminar on the day are introduced here (H&H Lawyers’ LinkedIn page, which I worked on together).

Ken Takahashi / Partner

Email: k-takahashi@kensei-law.jp